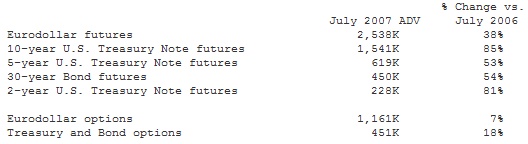

During July, 9 percent of Eurodollar options and 27 percent of Treasury and Bond options were traded electronically, and a combined 14 percent of the interest rate options traded electronically.

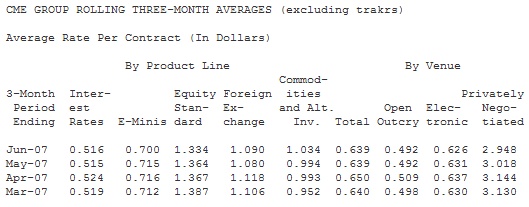

All references to volume and rate per contract information in the text of this document exclude our non-traditional TRAKRS products, for which CME Group receives significantly lower clearing fees than other CME Group products, and Swapstream products.

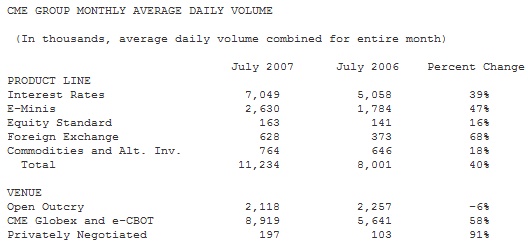

CME Group E-mini equity index product volume averaged 2.6 million contracts per day in July, up 47 percent compared with July 2006. Total equity options volume averaged 205,000 contracts per day, a 62 percent increase from the same period a year ago. Total E-mini index options volume averaged a record 114,000 contracts per day, more than doubling from July 2006.

CME Group foreign exchange product volume averaged 628,000 contracts per day in July, up 68 percent compared with the year-ago period, reaching the highest non-roll month average daily volume ever. Electronic foreign exchange volume averaged 585,000 contracts per day, up 75 percent compared with July 2006. July foreign exchange futures and options volume represented a notional value of $77 billion.

CME Group commodities and alternative investment products volume averaged 764,000 contracts per day in July, up 18 percent compared with the same period a year ago. Corn futures volume averaged 192,000 contracts per day, up 3 percent from July 2006. Soybean futures averaged 130,000 contracts per day, up 45 percent, and Wheat futures averaged 72,000 contracts per day, up 35 percent. CME Group electronic commodities and alternative investments volume was 49 percent of total CME Group commodities and alternative investments volume in July.

NYMEX energy and metals volume on the CME Globex platform in July averaged a record 750,000 contracts per day, increasing more than 7 times the average daily volume for the same period a year ago.

Methodology for Reporting Third-Quarter Results

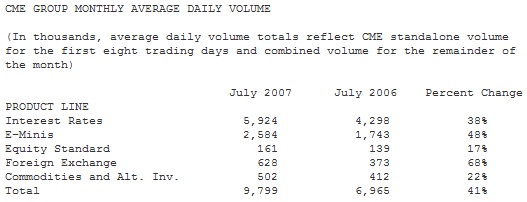

CME Group was formed on July 12, 2007, at the completion of the merger of CME and Chicago Board of Trade. For the purpose of quarterly reporting, volume will be calculated from that date onward in the following manner. CME standalone volume through July 12, 2007, plus the combined volumes of CME and CBOT for the remainder of the month, averaged 9.8 million contracts per day, up 41 percent from July 2006 using the same methodology.

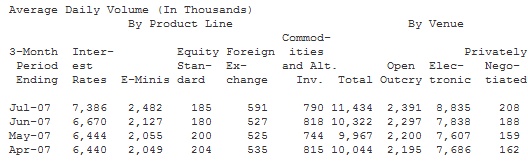

This methodology also will be the basis for calculating transaction fee revenue for the third quarter. Following is a breakdown of this comparison by product line.