In last month’s report, I noted that the decline in the number of IPOs carried over to the next fiscal year (meaning they are based on prior-year financial statements) was responsible for the downturn in the total number of IPOs. By the same reasoning, these “carryover IPO” companies could become the source of an IPO recovery during the second half of 2008. Companies that normally would have conducted a “carryover IPO” in April to June of this year may instead decide to use the fiscal year that ended in March 2008 as the basis for a subsequent IPO.

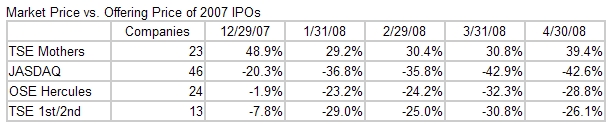

Next, let’s look at secondary market prices of IPOs in 2007 in relation to their offering prices.

The prices of these stocks have generally mirrored the market as a whole, dropping to a low at the end of March and then recovering somewhat during April. But on the JASDAQ market, which has an uncertain outlook, stock prices of these IPO companies did not bounce back in April. As a result, JASDAQ had the worst performance of the four markets shown in this table. A significant movement in the 2007 IPO stocks is unlikely to occur until investors see March 2007 fiscal year earnings announcements and forecasts for the current fiscal year. These announcements should be completed by the middle of May.

Thus far in 2008 we have seen 23 IPOs. As of April 30, 11 of these stocks were trading below their offering prices and 12 were higher. Furthermore, seven had market prices that were higher than their opening prices. It is difficult to lower evaluations of the 2008 IPO stocks because they have been traded for such a short time. But since Japan’s stock markets have performed so poorly since the beginning of 2008, valuation metrics used for the offering prices of the 2008 IPOs are probably lower than ever before. Consequently, once market conditions improve, and assuming that these companies perform in line with expectations, we should see prices of the 2008 IPO stocks recover to more than their offering prices.

Finally, investors should note that recent IPO stocks have started to rally. Techfirm (OSE Hercules, 3625), which had a March 27 IPO, and R-Tech Ueno (OSE Hercules, 4573), which had an April 9 IPO, are both trading at levels above their opening prices, which were higher than the offering prices.

Investors have been reluctant to invest in IPO stocks because earnings of these companies can be volatile and unpredictable. But the supply of IPO stocks has become extremely limited. With so few companies to choose from, we may once again see investors channel their funds to a small number of issues.

This environment is an excellent opportunity for investors seeking short-term gains. But investors who want to establish long-term positions should probably not start buying until the current market weakness has run its course. Even at that point, it will most likely not be too late to find attractively priced stocks.