Thus far in 2008, IPO opening prices are an average of 21.8% higher than offering prices. Since 2000, this figure was lower only in 2000 when the average increase was 18.5%. But the story is different in terms of the percentage of opening prices that exceeded the offering prices. In 2000, 64% of IPOs started trading above the offering price. In 2008, fewer than half of IPOs had an opening price above the offering price. This low percentage is caused by the much greater differences in opening prices of the 2008 offerings. In the past, investors were convinced they could make a big profit every time by purchasing initial and secondary offerings. But no one believes this anymore.

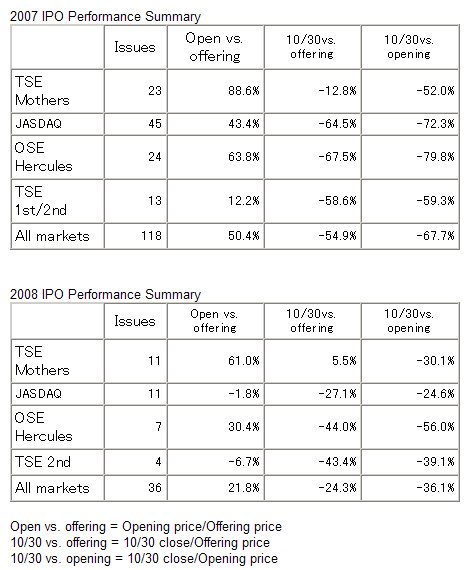

On the secondary market, IPO stocks have performed very poorly. Based on October 30 closing prices, 118 IPO stocks of 2007 are an average of 54.9% below their offering prices. For 36 stocks with a 2008 IPO, the average decline is 24.3%. By market, the Osaka Hercules has the largest stock price drops for both the 2007 and 2008 IPOs.

Let’s take a closer look at why prices of IPO stocks have continued to drop. Offering prices are determined by using comparisons with peer companies. A suitable price is calculated by using the PER and other stock price metrics of these other companies. Finally, the so-called IPO discount is applied to this price to come up with the offering price. That means offering prices carry much lower valuations than the stocks of peer companies.

But this approach has a problem: the valuation assumes that the stock market will remain flat between the price determination date and IPO date. Of course, stock prices have been falling consistently for more than one year. After an offering price has been set, prices of peer company stocks moved even lower. As a result, in many instances, this widely accepted method for calculating offering prices no longer yielded prices that were appropriate on the initial offering date. Investors must also remember that the central mission of initial and secondary offerings is to increase the number of shareholders of a company. Accomplishing this goal requires selling most of the shares to individuals.

Once an IPO stock falls below its offering price, individual investors are almost always the first to sell their holdings to cut losses. After that, regardless of a company’s future prospects and earnings, the stock price will continue to fall if institutions shun a stock from the standpoints of market capitalization and liquidity. This explains why most IPO stocks are staying below their offering prices.

I realize that my discussion thus far has covered only bad news. So I would like to end with an encouraging topic. All of you are certainly well aware that stock prices in Japan have dropped to a level seen only once every few decades. I urge you to pay attention to the fact that 2007 and 2008 IPO stocks have valuations lower than even the depressed market average. Many of these stocks have single-digit PERs but are not yet attracting the interest of institutional investors. Much more time may be required until companies finally see their growth potential accurately reflected in their stock prices. But an upturn in prices will require nothing more than a return to normal market conditions. This would very likely raise the prices of many IPO stocks as they climb back to average market valuations. Instability in the economy and financial markets will probably continue for some time. Even so, investors should regard today’s valuations as an excellent opportunity to pick up recent IPO stocks at bargain prices.