It is extremely unfortunate that the position of the markets for emerging companies within the entire market has declined and that IPOs have a diminished presence. But at the same time, the stock market has not given up its place as a supplier of risk money for venture companies, so as long as there are IPOs - even if the number has declined - I intend to keep watching and analyzing the IPO market.

In this edition of our monthly report, I will present my opinion on why investors have left the markets for emerging companies and whether month will flow back into these markets in the future.

The companies that are listed on these markets for emerging companies are ostensibly companies that have attractive potential for business growth. So a major factor is the fact that this potential for growth has disappeared. A total of 152 companies that conducted IPOs in 2006 and 2007 close their books in March. We compared the earnings forecasts released by these companies at the end of last fiscal year to their actual results.

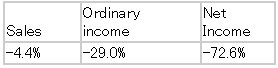

Sales, ordinary income, and net income all fell short of their forecasts. Net income, in particular, fell far wide of the mark (off by 72.6%). Next, we compared the forecasts for this fiscal year that were released when the companies published their early earnings releases (kessan tanshin) for last fiscal year.

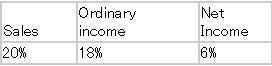

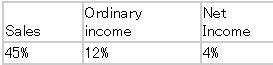

As you can see, they are forecasting an increase in both sales and profits. But wouldn't it ordinarily be difficult to achieve and increase in sales and profits in such a tough business climate?Next we split this year’s earnings forecasts into the first half and second half of the year. The following table shows the proportion that is attributable to the first half.

This means that companies expect to generate 55% of sales, 88% of ordinary income, and 96% of net income in the second half of the year. They are leaning too hard towards the second half.

Even individual investors who aren‘t completely knowledgeable about a company’s business won’t swallow these earnings forecasts and buy these shares based on a sense that they are undervalued due to low forecast-basis PERs. This is doubly true for foreign investors and institutional investors, who have no choice but to leave IPO names off of their list of investment options.

But even though the pool of IPOs contains both wheat and chaff, it all can’t be chaff. Because there is more chaff than wheat, it’s possible that valuations are based on the idea that it is all chaff. It would be fair to say that this is a great opportunity to seek out and invest in the "wheat" after checking a company’s business model, determining whether there is competition, seeing how it discloses information, and verifying its management team’s stance on IR.

Turning to the price movements for IPO stocks, the average opening price for the 24 IPOs up to the end of June was 34.9% higher than the offering price, while the average closing price on June 30 was 43.4% higher than the offering price, putting it above the opening price.

Until last year, there were hardly any issues that stayed above their offering price after about three months. But the slowdown in new offerings (down to one a month from April to June) has helped on the supply-and-demand front.

With just one new offering approved for July and three for August, there is absolutely no sense that there is a glut of new issues.

Therefore, it would be fair to think that among the IPOs in the second half of the year there will be few issues that will fall far below their offering price.

Investor can’t keep dabbling in the markets for emerging companies forever. It’s important to move only after painstakingly looking at each stock individually.

Investors should approach this market by looking at the tree instead of the forest.