"July was not kind to equity investors. However, year-to-date, all three benchmarks and eight of the 10 sectors are still in the black, with Energy, Industrials, Materials, and Telecom Services showing double-digit advances," notes Sam Stovall, Chief Investment Strategist of Standard & Poor's Equity Research Services. "While August does mark the beginning of a seasonally weak period, S&P's Equity Strategy Group believes we are in the midst of a pullback, poised for a correction, but not likely to enter into a new bear market. The difference between these terms is a matter of percentages."

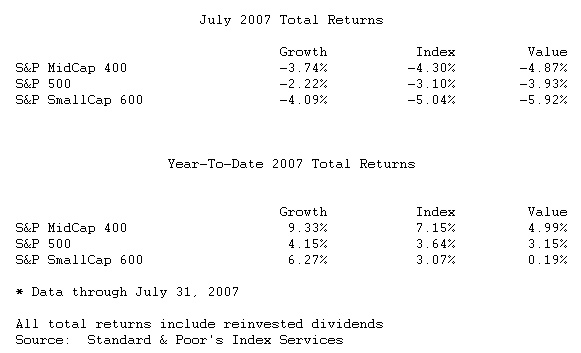

Year-to-date, however, the three major investment styles continue to show positive returns with the S&P MidCap 400 gaining 7.15%, the S&P 500 rising 3.64%, and the S&P SmallCap 600 increasing 3.07%. The best performing investment style over the first seven months of the year continues to be mid- cap growth as the S&P MidCap 400/Citigroup Growth Index has gained 9.33% through July.