"Most market observers talk of waiting for a positive second half of the year, but to keep its pace of new registrants without starting a trend of withdrawals, the markets need to pick up during the second quarter." said Maria Pinelli, Americas Director, Strategic Growth Markets, Ernst & Young LLP. "Patience and confidence are likely to ebb by June, but if you're a good company with solid business plans, practices and proven results, opportunities still await you in the markets."

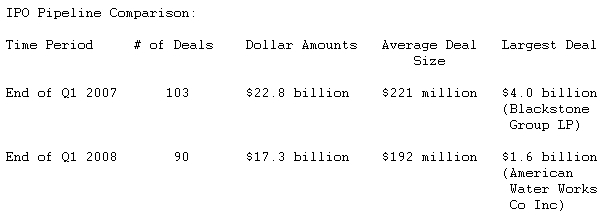

Compared to last year at this time, the overall IPO pipeline is not as robust.

"While the total numbers waned from last year, they also get older sitting in the pipeline," said Jackie Brya, Americas IPO Leader, Ernst & Young LLP. "In Q1 of 2007, companies sat for an average of 113 days compared to 163 days for Q1 2008. More than five months without resolving those costs can start to test any CFO's patience."

Among industry sectors, technology maintained the steady current to the IPO pipeline during this time of wait and see. The three most active sectors in the Q1 pipeline were technology (26 registrants), biotech (12 registrants) and pharmaceuticals (11 registrants). Technology also grew in dollar amounts, with companies filing to raise $3.3 billion, compared to $2.8 billion in the Q4 2007 pipeline. Oil and gas and pharmaceuticals filed to raise $1.9 billion each.

"Technology also continues to attract our foreign issuers, with four out of the five non-US pipeline registrations coming from technology or biotech. Pharmaceuticals are slightly more active than in Q4, but the oil and gas sector pipeline dove more than 60% from Q4's total dollars," said Brya. In Q4 of 2007, oil and gas companies were registered to raise $5.3 billion, compared to Q1 2008, in which they registered to raise $1.9 billion.

State by state, California companies were the most active with 15 filings, representing 16.7% of the total number of filings. Texas followed with 11 registrants, New York with eight and Massachusetts with seven.